When things look dire in the immediate term, it is more important than ever to zoom out and focus on the long-term. The fundamentals for copper are still intact — and better than ever.

The fact is, the world needs more copper and here’s why…

DEMAND

Throughout the last 100 years, the demand for copper has been largely influenced by the health of the global economy. This is due to its widespread applications in all sectors of the economy, such as power generation and transmission, construction, factory equipment and electronics.

While this is still the case today, in more recent times, the demand for copper has been increasing at an accelerated rate due to global decarbonization targets and copper being a key metal in the clean energy transition. Both the electrification of the global vehicle fleet and the switch to renewable energy for power generation will both require massive amounts of copper.

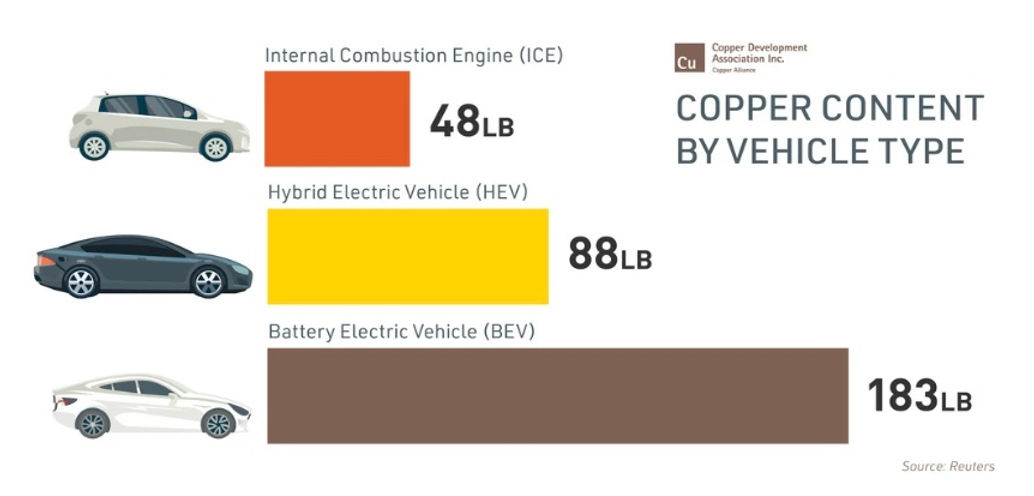

A single battery electric vehicle requires 183 lbs of copper, compared with an ICE vehicle which requires just 48 lbs of copper to produce.

Transitioning the world’s passenger vehicles into EVs would require the mining of more metals over the next 30 years than ever mined throughout history.

More than 700 million mt of copper will need to be mined in the next 22 years just to maintain 3.5% GDP growth, without taking into account the electrification of the global economy, which is the same volume of copper ever mined in history, Ivanhoe Mines Founder & Co-Chair Robert Friedland told the Investing in African Mining Indaba 2022 on May 11.

In addition, there is practically no alternative to copper as an effective electrical and thermal conductor (only silver is a better conductor but costs preclude it from being feasibly used).

S&P Global projects global copper demand to nearly double over the next decade, from 25 million metric tons today to about 50 million metric tons by 2035 in order to deploy the technologies critical to achieving net-zero by 2050 goals.

Consultant Wood Mackenzie has even called copper the “linchpin of a zero-carbon economy.”

This demand increase is not going to happen overnight.

With inflation growing in most regions of the world, central banks are now tightening their monetary policies which is leading to higher costs, particularly energy costs. These higher costs will affect consumer demand for goods and services, and therefore copper demand. So, the copper market may be at risk of a surplus in the short term, but the long-term fundamentals are looking better than ever.

Now let’s take a look at supply…

SUPPLY

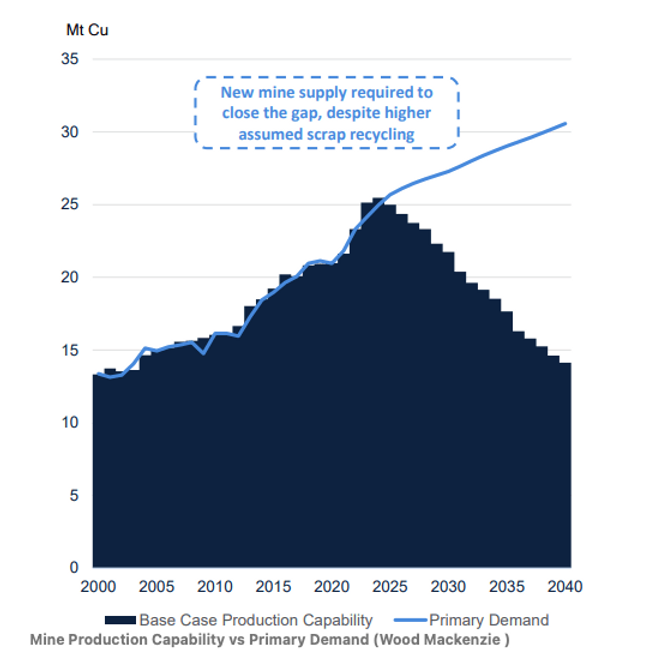

Growth in new copper supply capacity—from new mines or expansions of existing projects—is unlikely be able to keep pace with the surge in demand.

A lack of new discoveries, declining ore grades, geopolitical risk factors, and environmental, social and governance concerns are all set to impact the future supply of copper.

Copper supply shortfalls are predicted to begin in 2025 and last through most of the following decade.

A Lack of New Discoveries

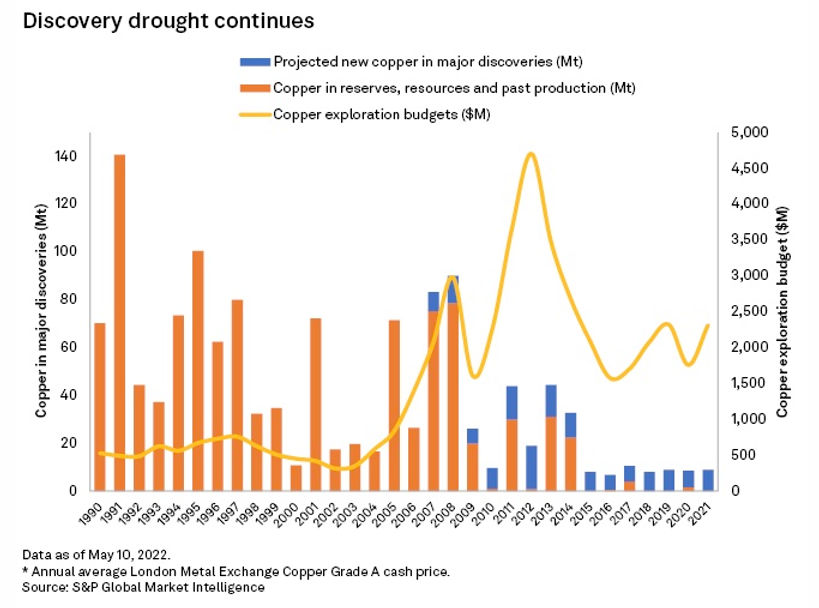

One of the biggest challenges facing the future supply of copper is the lack of new discoveries. While there are still large copper deposits that have yet to be fully exploited, the rate of new discoveries has been declining in recent years.

Despite elevated copper exploration budgets over the past several years, it has not led to a meaningful increase in the number of recent major discoveries.

One contributing factor is a key shift in focus within the exploration sector.

Since the 1990s, the industry has halved its share of annual copper budgets devoted to grassroots exploration, with the 34.0% allocated in 2021. Compare this with the late 1990s and early 2000s, when grassroots budgets ranged between 50% and 60% of exploration allocations.

Companies are focusing more on established assets: juniors at projects with existing resources and majors at and around their mine sites. Although some new major discoveries have been found at late-stage projects and existing mining camps, the probability of finding new major discoveries at such projects is lower than at riskier, early-stage prospects.

Given that the declining discoveries trend is showing no signs of reversing, copper demand will nevertheless exceed production by 2025-26, even if low-probability projects reach production. With copper demand expected to outpace refined copper production, the industry is not making enough new, high-quality discoveries to support the long-term pipeline.

It currently takes 16 years, on average, to discover and develop a new mine, meaning that a new discovery today would not become productive in time to accommodate the demand spike.

Declining Ore Grades

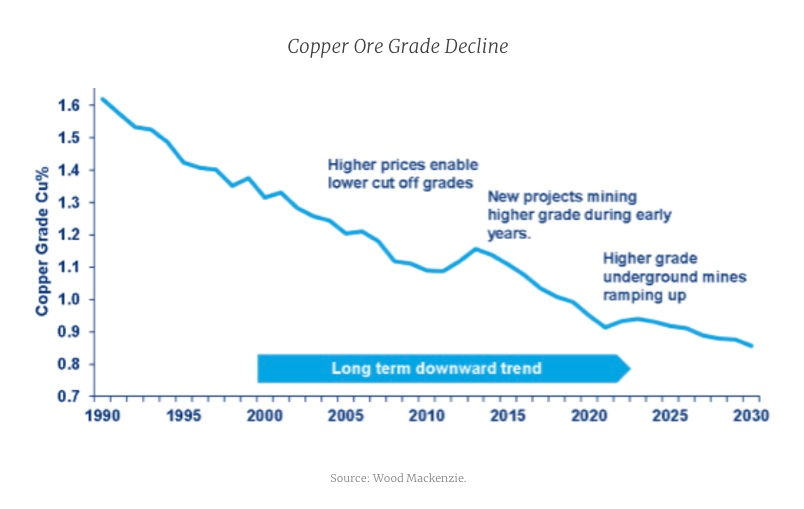

Another significant challenge facing the future supply of copper is declining ore grades.

Over the last few decades, since the copper discovery boom that gave rise to the Chilean copper mining industry in the early 1980s, the industry has since seen a consistent multi-decade trend of grade declines, which means that far more rock must be dug up, crushed and processed to produce the same amount of copper.

A prime example is CODELCO, the world’s largest copper miner, which has seen its ore grades decline by more than 30% over the last two decades through 2015 and its cost of production balloon as a result.

These declining ore grades are likely to lead to an increase in the future price of copper. As the amount of copper in each tonne of ore decreases, it becomes more expensive to extract the same amount of copper. This can increase production costs for mining companies, which may ultimately be passed on to consumers in the form of higher prices for copper products.

In addition, declining ore grades could potentially lead to a reduction in global copper production, which would reduce the overall supply of copper on the market. If demand for copper continues to grow, this could create a supply-demand imbalance, putting upward pressure on copper prices.

Political Instability

Many of the world’s largest copper deposits are located in politically unstable regions, which can create uncertainty around production and supply. Conflicts, changes in government policies, and social unrest can all impact the ability of mining companies to access and develop copper deposits.

Take Peru for example.

Peru is the world’s second largest producer of copper, behind only neighbouring Chile. Since December 2022, Peru has been engulfed by an escalating campaign of anti-government protests. The protests started in the wake of President Pedro Castillo’s arrest and removal from office, and support for him is particularly strong in southern Peru, including in the country’s second largest copper-producing region. Bloomberg estimates 30% of the countries production — roughly equivalent to 3 percent of the global total— is at risk because of political turmoil.

Conclusion

The future supply and demand of copper are expected to significantly impact the price of copper in the coming years. The growing demand for copper driven by the transition to renewable energy and electric vehicles, as well as infrastructure development and technological advances, is expected to increase the global demand for copper. At the same time, a lack of new discoveries and declining ore grades, coupled with the environmental concerns and political instability in copper-producing regions, are expected to put pressure on the global copper supply. This supply-demand imbalance is likely to lead to a rise in copper prices over the long term.

My Top Copper Pick

At the moment, my top copper pick is Atex Resources (TSXV:ATX) which has been hitting wide high-grade copper intercepts at its Valeriano Project, located in one of the most prolific copper districts on the planet — The Link Belt.

Phase III drilling is currently underway at Valeriano, following on from Phase II drill program that returned world-class intercepts including:

• 1,160 metres of 0.78% CuEq including 550 metres of 1.03% CuEq in hole ATXD-17.

Without a doubt, this deposit is shaping up to be a giant — with a strike length of known mineralization over 1,000m, width of over 800m and up to 1,000m of mineralization downhole. While the deposit looks huge already, it looks like it could be expanded even further — recent drilling has discovered a second porphyry trend with 2 rigs turning and a 3rd being mobilized.

The cherry on top for me with Atex is that the company is backed by mining billionaire, Pierre Lassonde, who is a +10% shareholder.

-SmallCapInvestor