The United States faces a pressing issue – it urgently requires more domestic sources of uranium.

As tensions escalate between the US and Russia over the invasion of Ukraine, the likelihood of Western sanctions on Russian uranium are becoming increasingly likely. Such sanctions would greatly impede the US’s nuclear power capabilities as nuclear power accounts for 20% of the US’s energy generation. Very little is produced domestically. The vast majority of the US’s uranium is currently imported from Russia, Kazakhstan, and Uzbekistan.

Despite being one of the largest consumers of uranium globally, there are limited production capabilities for the US as the break-even point for many US-based uranium mines stands at $60 per lb, while uranium prices are currently around $51 per lb. If these sanctions do occur, it will put immense upward pressure on uranium prices as the US scrambles to find new domestic sources of uranium.

STRATHMORE PLUS URANIUM (TSXV:SUU)(OTC:SUUFF) HAS THE POTENTIAL TO PROVIDE A NEW DOMESTIC SOURCE OF URANIUM FOR THE U.S.

I started writing about Strathmore Plus (TSXV:SUU)(OTC:SUUFF) a few months ago when it was trading around $0.35. I highlighted the company’s assets, management team, and most importantly the share structure. It ticked all of my boxes so I took a starter position at $0.35 and have been adding to it on the dips.

Since then, the stock has seen a lot of volatility, peaking around $0.70 but recently retracing to the $0.50 mark where it has been consolidating nicely. This stock is a fun one to trade as it moves quickly due to the tiny float (35M shares) and market cap of just $20 million, but more importantly, it stands out with its long term potential as an early-stage uranium play.

Despite being an early-stage exploration company, Strathmore Plus Uranium has multiple highly sought-after properties with HUGE potential, one of which has a history of past uranium production AT SURFACE and another which is directly adjacent to Cameco. Best of all, this company has a highly experienced management team with a history of previous discoveries and a VERY tight float to go along with it.

The Night Owl Project

Night Owl is, in my opinion, the most highly prospective of the company’s three assets. The Night Owl project is located in the Shirley Basin of Wyoming — an area with a long history of uranium mining and exploration. Other uranium companies in the basin include Cameco, enCore Energy, UR Energy, and UEC.

Not only is the project located in the heart of the U.S., but Night Owl was actually a past-producing uranium mine in the early 1960s, producing 93 tons at a grade of 0.24% U3O8, which was mined at or near surface. Uranium mining operations at Night Owl ceased not due to a lack of resources, but due to the low uranium prices, which were around $7. Since then, the Night Owl area has not been properly explored using modern exploration techniques but Strathmore Plus has plans to change that.

Rather than jumping the gun with an aggressive exploration campaign, the company has first decided to assemble the largest possible land package prior to turning on the drills. In December of 2022, they increased the size of Night Owl by 300%, adding a 640-acre mineral lease and staking 54 new claims in the area. This just goes to show how much this management team believes in the exploration potential of this land package. Strathmore plans to complete the geophysical survey in the upcoming year and start exploring the new parcels to increase the extent of uranium mineralization at the project.

Mr. Terrence Osier, PG, Vice President of Exploration for Strathmore commented, “We acquired the additional adjacent claims because they cover the same geologic formations and results of the geophysical survey indicate many additional and impressive areas of radiometric anomalies similar to the Night Owl mine site.”

On May 8th, 2023, Strathmore Plus submitted an application to drill on the Night Owl property. The exploratory plan includes 30 drill sites and 3,000 feet of drilling, to expand the areas of known uranium mineralization, that Night Owl produced from in the 1960s.

The Agate Project

The Agate project is also located in the Shirley Basin. Agate is an in-situ recovery (ISR) project, which is a low-cost method of extracting uranium that involves pumping a solution into the ground to dissolve the uranium, and then pumping the uranium-rich solution to the surface for processing.

Strathmore Plus recently announced they are planning a 100-hole drill program for a total of 15,000 feet at Agate this summer once the drilling permit is approved. In conjunction with the drilling, Strathmore will conduct near-surface and downhole geophysical research by teaming up with the University of Wyoming to digitize historical drill data and vector in on new drilling targets. This partnership between Strathmore Plus and the University of Wyoming should allow the company to save both time and money in doing so – a great partnership.

On April 4th, 2023, Strathmore Plus received a drilling and exploration permit from the State of Wyoming for its Agate project.

The Beaver Rim Project

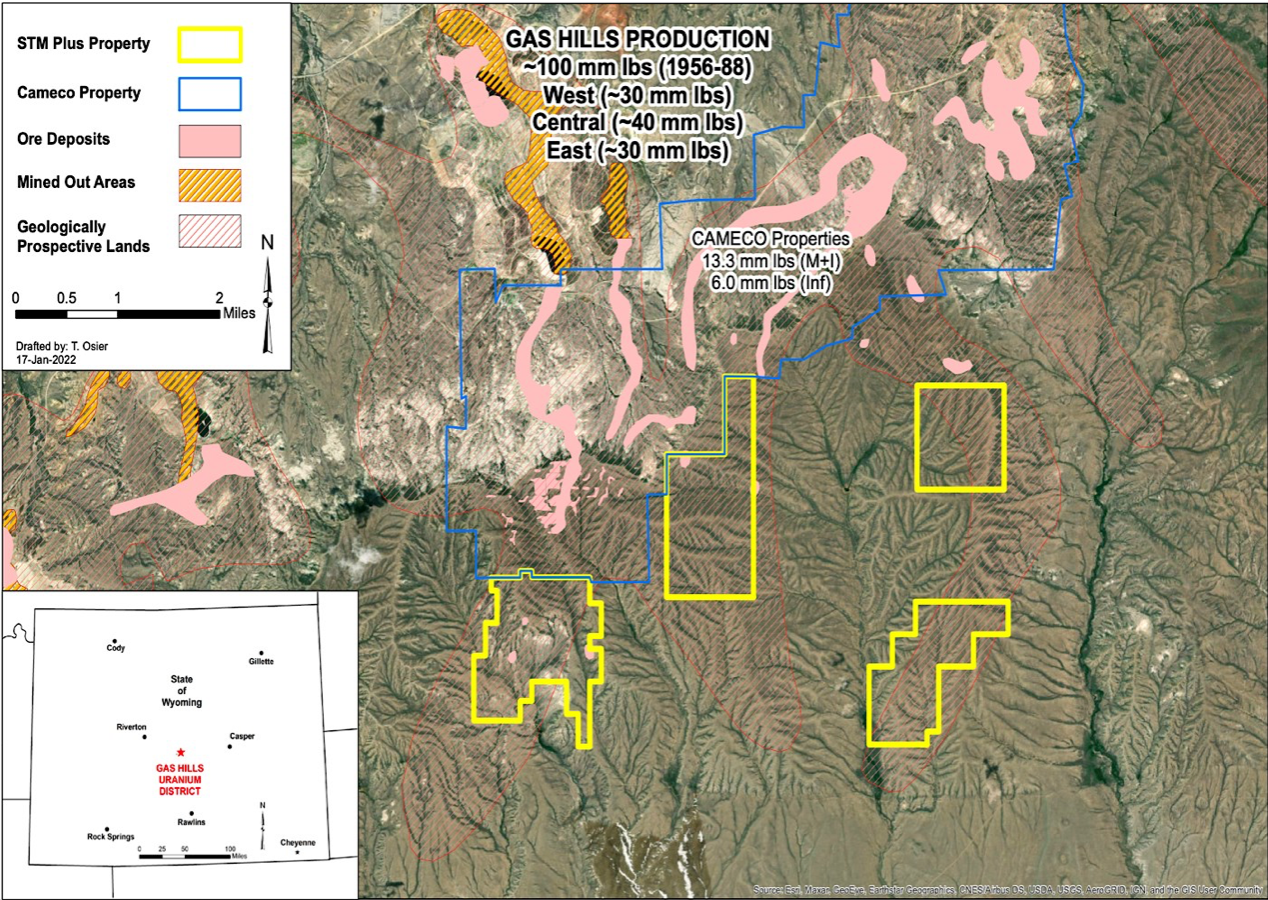

The Beaver Rim project lies immediately south of the main Gas Hills District, which is widely considered to be one of the most important uranium districts in the United States. Uranium in the Gas Hills area is generally considered to be of high grade and relatively low cost to extract. Much of the surface area near Gas Hills was extensively mined for uranium from the 1950s to the early 1980s, after which most of the mines in the area were put on care and maintenance due to low uranium prices. With uranium prices hovering around $50/lb, the area is starting to heat up again.

The biggest player in the Gas Hills area is CAMECO— one of the largest uranium companies in the world with a market cap of $15.5 billion.

Strathmore Plus’s Beaver Rim project is DIRECTLY ADJACENT to Cameco’s Gas Hills-Peach Uranium Project. Cameco’s property in the region boasts M&I resources of 13.3mm lbs of uranium and another 6mm lbs in the inferred category. Given the close proximity of the Beaver Rim property to Cameco, there is a chance that this resource may also spill over onto Strathmore Plus’s property.

Previous exploration on Beaver Rim, including as recently as 2012 by Strathmore Minerals Corp., discovered MULTIPLE ZONES of uranium mineralization on several of the claims acquired under this purchase agreement. Historical and recent reports suggest 50-100 million pounds of uranium resources remain in the Gas Hills, with significant discovery potential in the less explored areas to the south, right in the Beaver Rim area where Strathmore Plus is located.

The Bottom Line

It is still very early days for Strathmore Plus Uranium. The company ticks all the right boxes for investors in terms of asset quality, management team, and share structure and with such a low float and market cap of only $16 million, it provides a huge opportunity for both short-term traders and long-term uranium investors to capitalize on the inevitable rise in uranium prices. In addition, the company’s highly anticipated upcoming summer drill program could act as a major catalyst for another explosive upward move in the share price.

DISCLOSURE

The publisher of this report was paid a fee of ten thousand Canadian dollars by Strathmore Plus Uranium for the publication of this and other reports regarding the Issuer for a period beginning on or about March 14th, 2022 and set to end on or about June 14th, 2023. The purpose of this compensation was to cover the author’s time, research, and expertise in analyzing the company. It is important to note that the payment received may create a potential conflict of interest, as the author may be influenced by the compensation received. Readers are advised to consider this disclosure when evaluating the credibility and objectivity of the information provided in the article. While the author has made reasonable efforts to ensure the accuracy and reliability of the content, readers should conduct their own research and analysis and seek independent financial advice before making any investment decisions related to the small cap company mentioned.The compensation received by the author does not guarantee or imply any specific outcome or recommendation regarding the small cap company’s investment potential. This disclosure is intended to provide transparency and assist readers in understanding the context in which the article was written. From time to time,the author of this report,the publisher, and the publisher’s directors, officers, and other insiders may purchase or sell securities of the Issuer.