It goes without saying, things have been quiet lately.

The markets have really tapered off since last year, especially in the telehealth and mining sectors and in the meantime I have been focusing my attention in other asset classes. But after these recent summer doldrums, I do believe that we will start to see more capital flow into the junior space over the coming months.

For now, I have offloaded my position in every single stock except for one — Titan Mining (TSX:TI).

I am down heavily on this position right now but I still strongly believe that Titan has the potential to become a multi-dollar stock.

Although things did not pan out with the gold property at Mineral Ridge, that was an exploration punt to begin with. Fortunately, the company still retains 100% ownership of the Empire State Mine (Zinc) in New York State and has been making incredible progress over the last few months.

Let’s have a look at the most recent quarterly financial statements:

We can see that Titan did $13.2M USD in revenues over the last three months alone.

Comparing this amount to last year, that is growth of over 100%.

Remember that the amounts shown are in USD. So the equivalent amount of revenue in CAD would be $16.75M. That is nearly $17 million in revenue over the last 3 months alone!

Now if we extrapolate that amount and forecast revenue over the next four quarters, we derive the ‘22 expected annual revenue to be around $67M CAD.

The stock is currently trading at a $50M market cap or 0.7x FY’22 Revenue.

So we see that revenues are growing quickly and should continue to do so over the foreseeable future…

But what about margins?

Not only has Titan been rapidly increasing their revenues, they have been simultaneously decreasing their costs. This has resulted in higher margins and even more importantly, the company’s first ever profitable quarter of $1.5M USD ($1.9M CAD) – of which $1.4M will be paid back to shareholders via a dividend on October 15th.

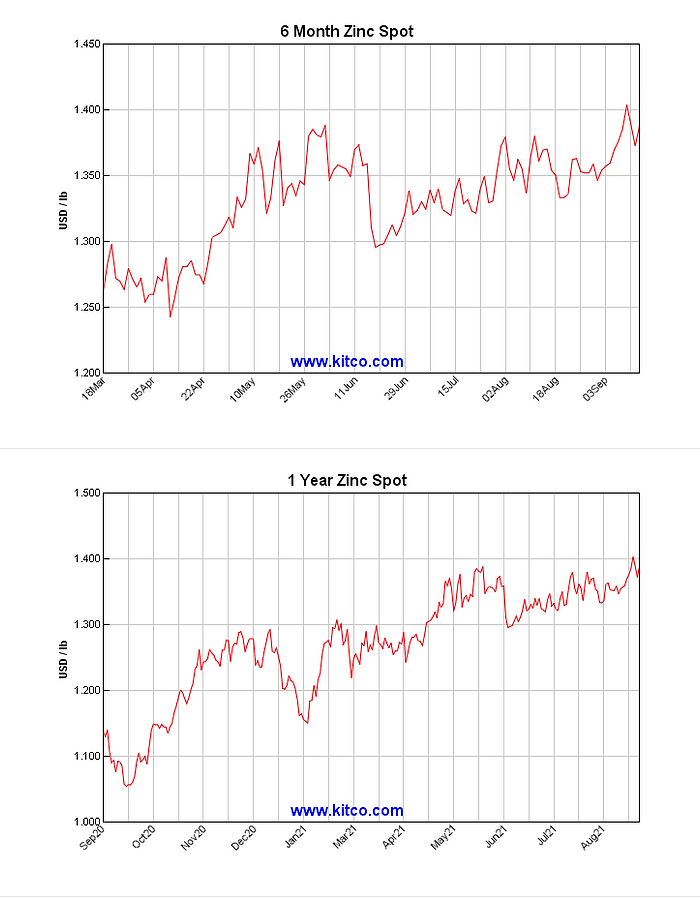

Given that Titan Mining is now a pure play zinc producer (but don’t forget about the exploration upside), it would be safe to assume that share price fluctuations will be more closely correlated with commodity (zinc) prices.

Looking at these price charts for zinc, we see that the zinc price been increasing steadily over the last year and looks to be heading higher.

Overall, the financials for TI look great and the macros do too.

Despite this, the share price performance has been lacklustre to say the least. The stock is down over 50% over the last 12 months and is currently trading at the lower end of the 52-week range.

So what gives?

I think a large part of the recent decline can be attributed to the company pulling out of Mineral Ridge gold asset. When the company made the M.R. announcement, the stock jumped from $0.30 to almost $1.00, entirely on speculation. It seems that investors were considering Titan to be a gold exploration play and forgetting almost completely about the zinc asset.

Fast forward a year later, the company has pulled out of Mineral Ridge and the stock has slowly declined back to the $0.30 range — exactly where it was trading before announcing Mineral Ridge.

Now I would say that this drop is entirely rational if it weren’t for the progress that Titan has been making at ESM.

Let’s do a recap of the progress at ESM:

- Revenues increasing rapidly

- Cost cutting resulting in higher margins

- First ever profitable quarter + dividend announcement

- Rising zinc prices

Despite all of these positive developments, the stock is trading as if none of this has even happened. The market appears to be discounting the company’s progress almost entirely.

There could be a many number of reasons for this but in my opinion, it likely has to do with legacy shareholders.

Remember that Titan Mining originally had its IPO at $1.40 and quite a bit of money was raised at that level. So there may still be legacy shareholders who are underwater significantly and just want out.

Another thing to keep in mind is that Richard Warke still owns over 56% of the entire float and I have never seen him sell stock in the public markets (only sells at buyout). This essentially means that there is a massive chunk of the float unavailable for public purchase, which would explain the low trading volumes and lack of liquidity compared to other TSX stocks.

It seems the only people aware of Titan’s undervaluation at present are insiders.

Don Taylor and Richard Warke have both been adding to their positions in recent months.

Now remember that Don Taylor, CEO of Titan, is no stranger to zinc mines. He is the recipient of the 2018 PDAC Thayer Lindsley Award for the 2014 discovery of the Hermosa-Taylor lead-zinc-silver deposit — owned by Arizona Mining, which was ultimately acquired by South32 for over $2.1B.

As for me, I have also decided to weather storm and have been slowly adding to my position.

Although there has been alot of shares sold lately, the selling pressure is coming from only a few specific trading houses, which likely means only a few different sellers. Legacy shareholders are selling while insiders are buying.In my opinion, the sellers are nearing the end of the rope in terms of their position and will likely be flushed out in the coming weeks.

TI should run hard as a result.

– SmallCapInvestor